Wall St Rank CEO Amrit Rupasinghe noticed a sharp rise in the number of people turning to Tik Tok and YouTube during the pandemic, looking for “expert advice” about investing.

He realised time-poor investors were relying on social media platforms when researching stock ideas – and that gave him a great idea for his business. It’s a classic case of being able to pinpoint a gap in the market and move on it quickly. Now Wall St Rank is helping people access stock ideas, based on the consensus opinion of top Wall Street analysts.

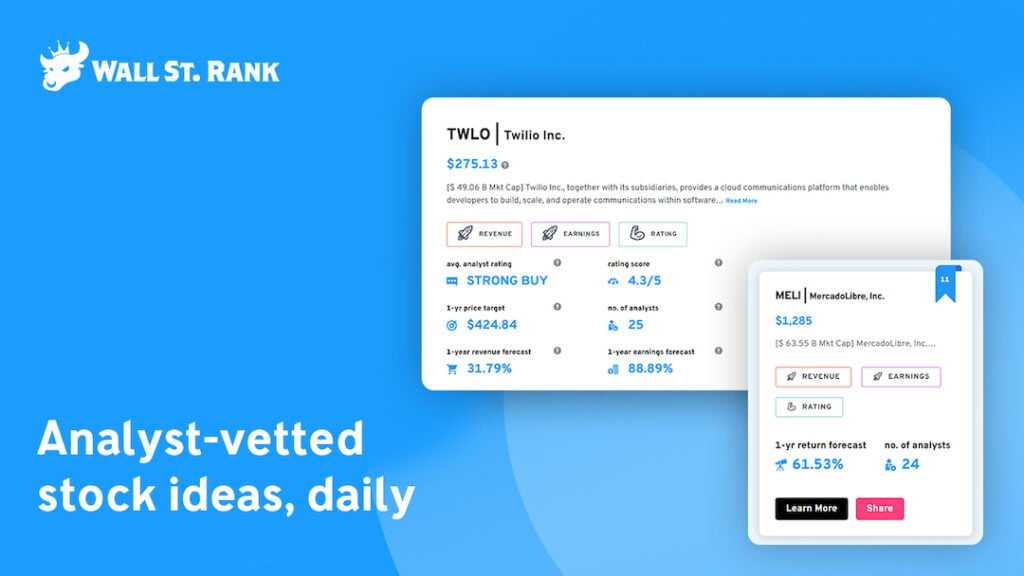

Amrit sees his business as solving a major problem for investors, by shortlisting analyst-vetted stocks from a pool of over 7,000 stocks listed on the US exchanges.

“This is particularly difficult for people from non-US countries investing in that market.,” Amrit explains.

“When time-poor investors look for stock ideas by looking at Tik Tok, this results in a lot of misinformation being spread, and investors getting burned. We want these investors to know that they can easily get signals from sector-specific analysts who deeply understand the sectors and the companies they cover.”

Here’s a video about their mission.

As Wall St Rank is entirely bootstrapped; Amrit has been relying on a team of freelancers who’ve been working on different parts of the project. He says this aspect of the work has been challenging.

“Managing different time zones, communication mediums and work styles have been quite challenging. I’m happy to say that we’re cracking $ 5,000 in MRR, so I can start to spend more on reliable dev resources.”

“Our biggest success is the main source of traffic for us is referral, and we’ve had 40,000+ visitors to the site from 165 countries. It goes to show that we’re solving a real problem for part-time investors – especially those that are non-US based.

Amrit sees Wall St Rank as part of the wave of new Fintechs democratising Wall Street for part-time investors. His vision for the product is to be the go-to resource for smart money signals.

“We started with sell-side analysts’ ratings, but we want to highlight what the buy-side is actually investing in as well. For example, we’ll soon be ranking the top 100 Hedge Funds by performance, and sharing their holdings,” Amrit says.

“In the past, you would have had to park at least a $1M with a fund to know its holdings – with Wall St Rank you can do so with $ 11.99/month. That’s very powerful.”

- Why analyst predictions are useful

“Analysts typically cover sectors they have some domain interest/expertise in, and they go deep. They also have access to complex financial models that help them project the growth of certain metrics on the stocks they follow. Other than scrutinising financial statements, filings and material announcements, they also consider macro-economic data, industry tailwinds/headwinds, tour facilities, have access to management, fellow bloggers and talk to suppliers, and customers. In contrast, a part-time investor can spend around two hours researching all the companies they are interested in per week,” Amrit says.

- Knowing where the data comes from

“Analysts cover multiple companies in their respective sector, and provide detailed research reports on them (which they update when assumptions for their previous assessment has changed). These reports have to be purchased directly from the firms, and are too expensive for the average investor to purchase. We work with certain financial data providers that have relationships with these analysts to access summary data from their reports (rating, price target, revenue estimate, earnings estimate, beta),” Amrit says.

While, on the surface, Wall St Rank seems like a simple product, Amrit claims he’s faced countless issues throughout the journey – leading to two important decisions that are now at the heart of the business.

“The two decisions I’ve made are; to make Wall St Rank a popular research tool for part-time investors globally. And that I won’t stop until Wall St Rank is a popular research tool for part-time investors globally.”

“And I’d like to share some advice for other start-ups; join a start-up community for support – Fishburners has been great for us. Being part of a community that’s striving to make positive change in people’s lives has been very helpful. Also, most first-time founders focus on product. But, as a second time founder, the biggest difference in my approach is focusing on distribution above everything,” Amrit says.

“I have ten times less resources than I did in my last company, but the scale I’m experiencing with this venture is far greater because I prioritised my go-to-market strategy. I plan on evolving the business to become the go-to-resource for all smart money signals. For example, we will soon be displaying the rationale behind a specific analyst rating and price target on a stock, and also which top fund managers are buying it. I am really excited for how the platform is going to evolve in 2022.”

If you enjoyed this start-up story, read here for more.