David Rennex, CEO and co-founder of AI-powered debt recovery platform, DebtForce, gives us the run-down on navigating fundamental finances when times are tough.

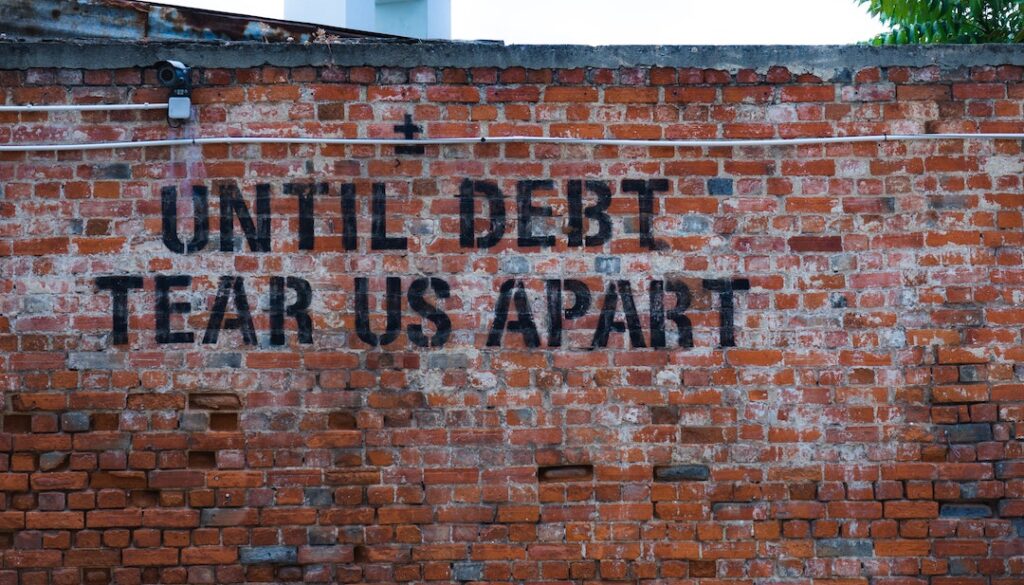

Late payments are seemingly ingrained into Australia’s business culture; however, it’s small businesses who suffer the brunt of this systemic problem, with the knock-on effects leading to long-term damage.

The average late payment time for an Australian business is 11.7 days. The impact of this goes beyond inconvenience; it’s proven that SMEs that are consistently paid late grow their revenue at three-times a slower rate than their paid on-time counterparts. Moreover, nearly a third of Australian SME owners estimate their company to have over $20,000 in outstanding receivables at any given time.

Research shows that almost one third of small business owners spend over eight hours per week chasing payments; that’s 50 full working days a year – time that is simply not at their disposal.

Managing overdue payments is not always straightforward. For small businesses owners in particular, maintaining positive customer relationships can be almost as important as getting paid on-time. There’s no handbook on when and how a business should act, especially if you’re unclear on the difference between late payments and bad debts.

What’s the solution? Prevention and protection are the best methods for managing any kind of debt. Here are three ways to establish safe invoicing practices and navigate payment reconciliation.

Clarity is key

A significant cause of bad debt debacles is unclear or vague customer agreements; this is especially prevalent around invoicing terms and deliverable services.

While customer agreements will look different for everyone depending on the size of your business, available cash reserves, and volume of clients; building solid foundations around your invoicing practices is the best way business owners can minimise overdue receivables.

Be crystal clear on what you will deliver and when, and be sure to invoice customers quickly after the services or goods have been provided, if not before. Secondly, create detailed payment terms. For small business owners, the standard invoicing practice is anywhere between seven and thirty days; you then might want to include a ‘grace period’ for trusted or long-standing customers.

Distinguishing late payments from debt is a grey area for many business owners; however, late payments technically become debt when they fall overdue to the agreed-upon invoicing terms; this is why it’s so important to stipulate in your agreements when the ‘grace period’ ends. Get all of your communications in writing, and set up regular payment reminders to ensure your customer doesn’t have the opportunity to forget.

The more detail you provide in your customer agreements, the less likely you are to be challenged on payments and deliverables, so invest time in creating watertight contracts at the beginning of your business relationships.

Know when to act

Part of the reason why it’s so important to set clear invoicing terms is so that you know when to act on reconciling payments, as the longer you wait, the less likely you are to recover a debt successfully.

As stipulated in your contract, when an overdue invoice tips over into debtor territory, you will need to consider your options around how you wish to recover the payment. Depending on the size of the debt, you may need to consult an expert, such as a lawyer, for guidance. Be mindful of the fees associated with this, as you will likely be charged for your lawyer’s time and communications with the debtor.

Given the high cost associated with traditional debt recovery practices, it’s a good idea to explore the market. Technology-based debt recovery platforms, for example, can be an affordable solution, while streamlining and speeding up the recovery process to maximise recovery rates.

Ultimately, if you choose to engage professional help, you need to weigh up whether it’s worth good money to recover bad debts.

Remember your reputation

Confrontations are always challenging, especially when you’re the one having to initiate them. Keep in mind though, that debt recovery doesn’t have to become a messy dispute – if you’ve delivered your end of the deal, you are well within your rights to ask your customer to do the same.

Many small business owners put off chasing debts out of fear that they will damage customer relationships; however, the faster you act, the higher the likelihood of the debt being recovered successfully. While it might be uncomfortable to challenge your customers, it’s a necessary part of owning and operating a business.

The critical thing to keep in mind here is your company’s reputation. All communication should be done in writing, using clear, concise language and a respectful tone – remember to archive all of your email chains too, just in case. If you’re in the position to do so, offer your debtor options such as staggered repayments; if you’re consulting an expert, they should be able to advise best practices for reaching a compromise.

If you want to continue doing business with your customer once their debt has been recovered, you need to find a solution to avoid a repeat scenario. Consider implementing stricter payment terms, and making an alternative payment method, such as automated Direct Debit, compulsory so you can guarantee a prompt payment for next time. As mentioned before, the best way to deal with debts is prevention, so work hard to find a solution that will suit you both.

Small business owners need to use their time wisely – after all, it’s one of their most valuable resources. If your late-paying debtors continue to be inflexible, you may want to consider whether they are really worth your business. Sometimes, the best way to protect yourself is by cutting your losses.

David Rennex, CEO and co-founder of AI-powered debt recovery platform, DebtForce: a simple tool that assists creditors to recover debts quickly and easily through the use of digital technology.

Click here to discover everything you need to know about payrolls.