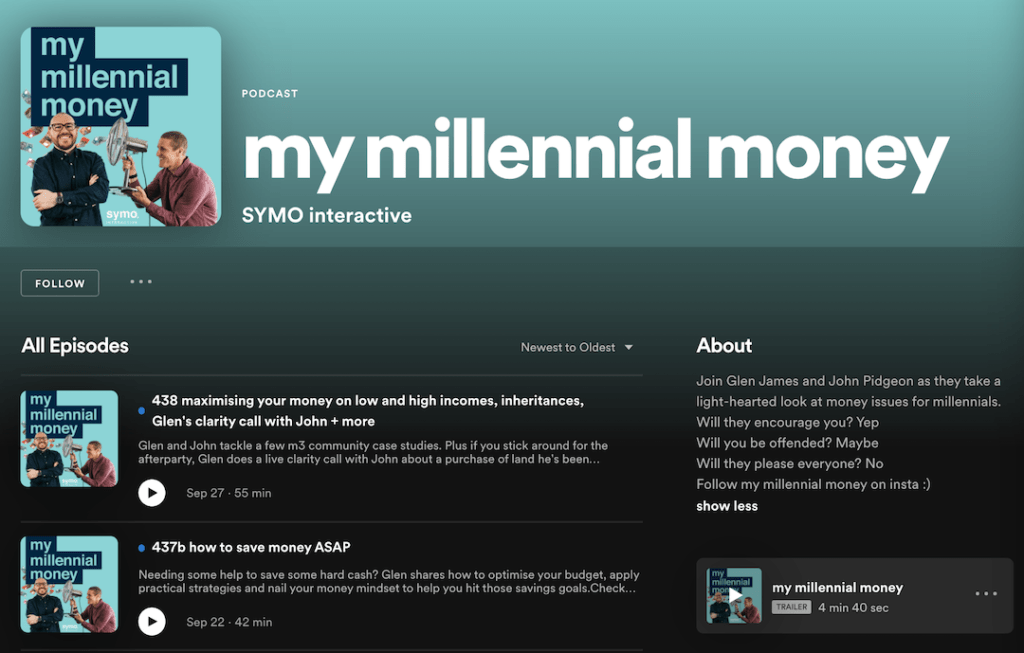

Finance guru, podcast host and now author, Glen James from my millennial money shares his tips for getting on top of your finances.

Glen James’ new book Sort Your Money Out and Get Invested is about to hit the shelves. The former financial advisor and host of the prolific Australian finance podcast my millennial money shares his no BS guide to getting your finances on track. Glen gave us a sneak peek at the new book and shared some of his most valuable insights with us.

Did you ever imagine your insanely popular podcast would lead you to where you are now?

Honestly, I am grateful to be where we are now, but I never expected it to go this far. I say we because I have a really good team that helps deliver content to people each week. I want my path to be an example to others that if you like what you do and double down on it – anything is possible.

Tell us about how you got into finance.

I always had a passion for personal finance and investing. I remember when I was 16 going to a community college course on shares on a weekend. It was just me and a handful of retirees. I had the best day! This passion has never left me. I left school to do a trade in telecommunications, but I soon realised that I needed to lean into the money stuff. I studied at a private college and got an entry level role at a financial planning firm. At 25 years old, I started my own business and after 10 years decided to merge my firm with another. Then I went all in and created my millennial money.

You have very strong views about debt consolidation. Why is that?

I share a story in the book about a client who came to see me when they were about to retire. He had refinanced consumer debt onto his mortgage his whole life and it finally caught up to him. The thing is, when people consolidate debt, they think they are doing something. They are not – they are just moving the debt. It’s important to change underlying spending habits and not consolidate the debt.

Explain the difference between “good debt”, “bad debt” and “life debt”.

My overarching feeling toward debt is that I don’t like any of it. If I could own a home without it, I’d certainly do that! Who wouldn’t? Many financial commentators categorised debt as good or bad.

Good debt: attached to an asset that is appreciating in value & tax deductible to you

Bad debt: not secured to anything and not tax deductible (think personal loans, credit cards)

Life debt: I like to call debt that is in our life that doesn’t really fit into the above categories. Like your home mortgage or HECS/HELP debt.

What is “human capital” and why is it so essential to wealth creation?

As humans, most of us go to work and exchange our time for money. This money or “capital” is a direct exchange from our efforts. For me it helps to change the perspective of what’s left over after my expenses are paid. I see this as human capital and I want to transfer as much of my human capital to growth assets to maximise the return on my labour costs. A lot of wealth creation is about mindset and this was one aspect that really helped me focus on building wealth over the long term.

You’re not a fan of budgets. Instead, you talk about “spending plans”. What’s the difference?

A lot of what we do as humans actually comes down to the vernacular we use. People that are on a “food plan” rather than a diet have more success because they have set up the system in a way they can win. That’s why we use the term “spending plan” – it’s a budget but on your terms. LOOT (Life On Own Terms) is a phrase I live by and encourage others to as well. Further, I don’t want to be restricted week on week with specific categories, I just want the freedom to spend on whatever I wish, when I feel like it and my spending plan does that for me.

What tips would you give buyers for breaking into the current property market?

Listen to my millennial property podcast. Not even joking!

Let’s talk investing. When and how should people start investing?

Whatever you do with your investing, it should be your idea not someone else’s. You should first understand your appetite for risk. I dive into all of that in Sort Your Money Out & Get Invested.

When is it time to make the leap from micro-investing to “real” investing?

Honestly, it’s not time to invest until you have your Sound Financial House in order. This means, getting your spending plan sorted, insurances, etc. I would say you can start to dabble in micro-investing while you’re getting your money sorted, but only when you have got everything in order and sought advice – then go for it!

What are your thoughts on crypto currency? Is it a part of your portfolio?

It’s a relatively new asset class, so caution should be taken. I believe due to the volatility of cryptocurrency day-on-day, it’s not a great tool to replace money. If you purchased a $20 item one day with a digital coin and the following day the value of the coin fell significantly, you overpaid for that item! I do hold some bitcoin, however, not more than 2% of my total portfolio. I think I hold it out of personal interest as I’m keen to see what happens in this space.

What are 3 mistakes people often make when beginning their journey to financial freedom?

- Not identifying goals for their life, short term and long term

- Not having a strategy for each goal with some room for pivoting if things change

- Not seeking professional advice when needed

What is the most important piece of advice you would give to people seeking financial security?

Be very clear on what YOU want and how YOU will achieve it. Just because someone else needs something or does something – you DO NOT have to. Society sucks us into the notion of following the pack. Do some LOOTing… Life On Own Terms.

Glen James’ book Sort Your Money Out and get Invested is available for purchase here. You can find out more about Glen’s work at mymillenial.money.com.