A world-class payroll system is a key asset for businesses navigating today’s ongoing skills crisis, fast-changing regulatory environment, evolving workforce arrangements, and increasing domestic and international competition.

The right system can help a business retain and engage talented people, ensure regulatory compliance and establish a reputation for diligence and professionalism.

At Workday, we believe there is no better opportunity for Australian businesses to review their existing payroll systems and seize the opportunities a modernised payroll system can deliver.

They can dispense with legacy or disjointed systems used to enter time and people data, eliminating excessive workloads and high error rates.

They can overcome issues reconciling data from multiple sources.

They can avoid any difficulties complying with changes to taxation arrangements across multiple levels of government or responding quickly and accurately to global process changes or decisions that impact payroll. This minimises slow or incomplete responses that may potentially expose them to reputational damage and financial penalties.

Finally, they can undertake a detailed analysis of payroll data for accuracy and compliance and combine this data with other people and financial data for a holistic view of their position.

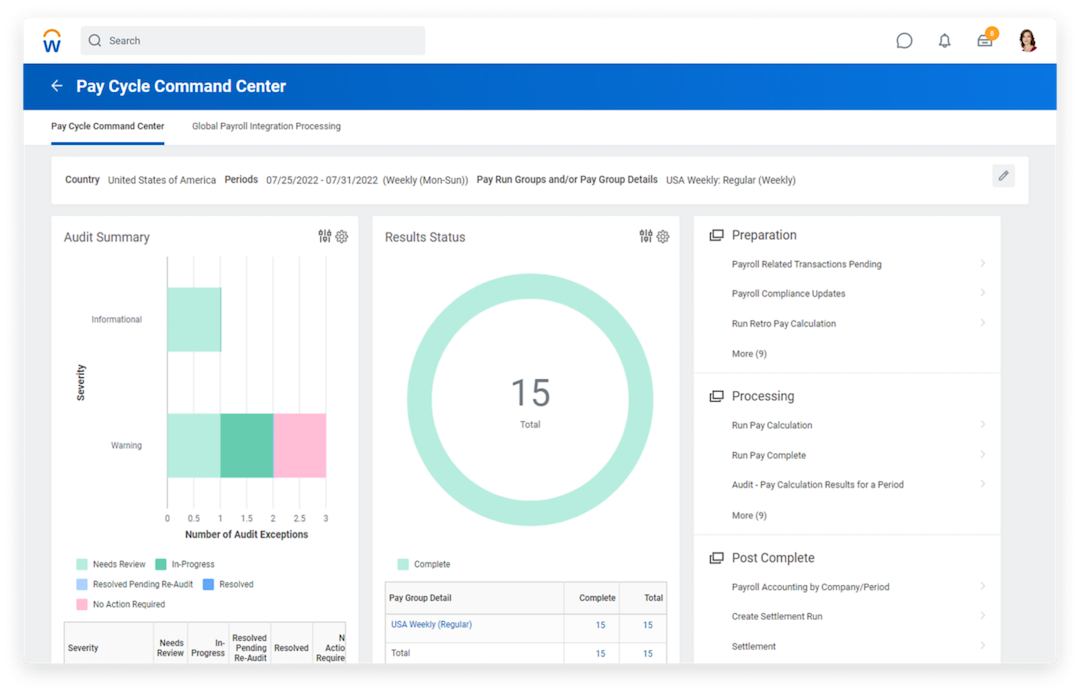

Workday payroll systems. Image: Workday.

Turning to Workday Payroll Australia

How can they do this? By deploying Workday Payroll for Australia.

Building on our Australian leadership in cloud-based human capital management, financial management and adaptive planning with a move into payroll in this market was a natural next step for Workday.

We’re highly experienced in developing and delivering payroll to customers in key markets, providing solutions directly in the United States, Canada, France and the United Kingdom.

We also work with global partners to deliver payroll solutions across more than 120 countries worldwide.

Image: Workday.

A compelling case for change

Why change now? The case for upgrading payroll capabilities at this time is compelling. Research conducted by the Australian Payroll Association reveals that, post-pandemic, more than half of payroll professionals are dealing with increased workloads. Also, about one-third are challenged by payroll processes, challenges, and certainty around payroll compliance.

At Workday, over recent months, we’ve worked with several early adopter Australian customers to test and refine our payroll product in this market.

With this rigorous process assuring compliance with Australian laws, regulations and business practices, we’ve made Workday Payroll generally available to Australian customers.

This is an opportunity for new and existing customers to secure a new level of control over their business processes, data, and costs and gain the flexibility to configure payroll to accommodate their changing business needs.

Administrators at current and prospective customers can now access the real-time, intuitive Workday experience while benefiting from continuous payroll calculations, smart payroll audits and built-in reporting.

Workday payroll systems. Image: Workday.

Refining Workday Payroll Australia with customers

Customers helping us refine Workday Payroll for Australia include the Workday Practice at professional services firm Cognizant. The first customer to go live on the solution, Cognizant Workday Practice, has used it to pay about 100 employees each month for about the last six months.

Elaine Hanner, Payroll Director, tells us the practice has saved a week in processing time, improved overall accuracy and enabled successful reporting to the Australian Taxation Office.

If your business is looking for connected, consistent data with a level of accuracy that helps establish a genuine system of record, Workday Payroll for Australia can meet your needs.

The solution can help you unify human capital management and payroll, undertake seamless financial reporting and generate insights that help deliver a granular, holistic view of the business.

You can also adapt rapidly to changing regulations and events that impact payroll and scale the system as required.

Further, with automation, machine learning for anomaly detection, continuous payroll calculations and autonomous payroll runs, you can redeploy resources to prioritise innovation.

We’re extremely proud to bring Workday Payroll to the Australian market to generate opportunities for new and existing customers. With the product, your business can reduce the workload of payroll professionals, eliminate challenges around payroll processes, and deliver certainty around payroll compliance. Ultimately, you can transform payroll into a key contributor to business performance, reputation, and talent retention.

Jo-Anne Ruhl is the Vice President and Managing Director, Workday Australia and New Zealand.

If you enjoyed this piece about payroll, you may like to read more of the latest business news in Australia.